When the stock market gets choppy, growth stocks often get hit the hardest. And this is no accident – their future cash flows are often less certain than value shares or dividend stocks.

In general though, these things tend to be fairly cyclical. I don’t know exactly when things will turn around, but I think this is a good time to be looking at growth stocks for when they do.

Growth vs value

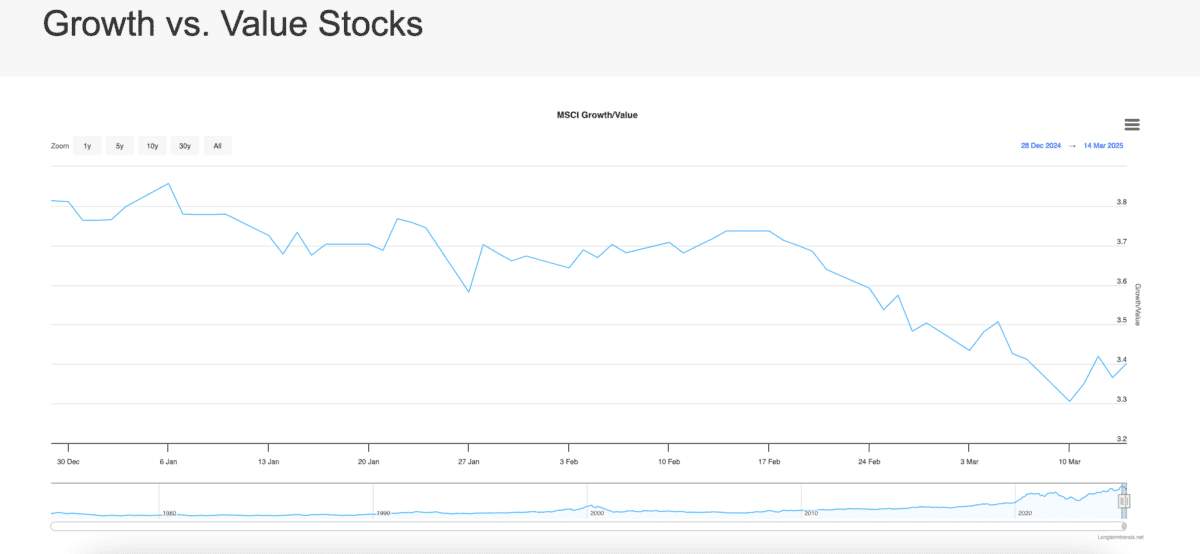

So far this year, the ratio of the MSCI US Growth Index to the MSCI US Value Index has fallen from 3.8 to 3.4. In other words, US growth stocks have underperformed value shares.

Should you invest £1,000 in Compass Group Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Compass Group Plc made the list?

Source: Longtermtrends

The same general trend has been true elsewhere. The FTSE 100 has outperformed the S&P 500 in 2025, but a big reason for this is the concentration of growth stocks in the US index.

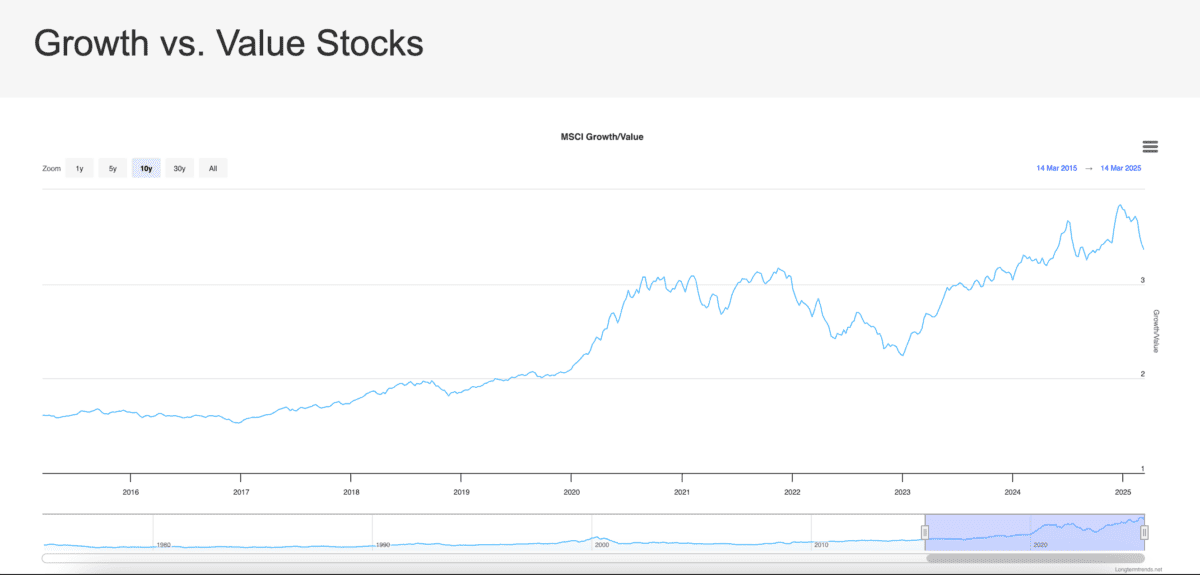

Investors however, should be careful. The gap between growth stocks and value shares has been closing, but it’s still towards the higher end of where it’s been over the last decade.

Source: Longtermtrends

As a result, I don’t see the latest downturn in the stock market as a time to go buying growth stocks hand over fist. But I do think it’s a chance to look for some specific opportunities.

A FTSE 100 grower

Compass Group (LSE:CPG) is a stock that has been catching my eye recently. Shares in the FTSE 100 contract catering firm have fallen 13.5% in the last month.

Despite this, I think there’s a lot to like about the underlying business. The company’s scale gives it a clear competitive advantage when it comes to negotiating bulk prices from suppliers.

On top of this, the most recent trading update reported some strong revenue growth. Organic sales were up over 9% and the firm is expecting this to stay above 7.5% for the rest of 2025.

Looking ahead, I think there’s also good potential below the top line. The debt level and the share count are both still high following the pandemic and reducing these should boost profits.

What’s the problem?

Despite this, the stock’s been falling sharply. And the most recent cause of this has been a double downgrade from Outperform to Underperform by BNP Paribas Exane.

The reason is that job reductions in the US – especially in the healthcare sector – could be set to weigh on demand. And that’s a legitimate cause for concern with the business.

I think however, investors need to keep things in perspective. Healthcare & Senior Living in the US makes up just over 18% of the firm’s total revenues. Given this, a decline of over 13% seems like a big drop and the current share price of £24.25 is below BNP’s revised price target of £25. As a result, I’ve added it to my watchlist.

Finding shares to buy

Growth stocks may have performed worse than value shares since the start of the year. But as a group, I don’t think they’re obviously in bargain territory just yet.

Individually though, I think there are some stocks that have fallen to attractive levels. Compass Group isn’t my top stock to buy just yet, but it’s one that I’m keeping a close eye on.